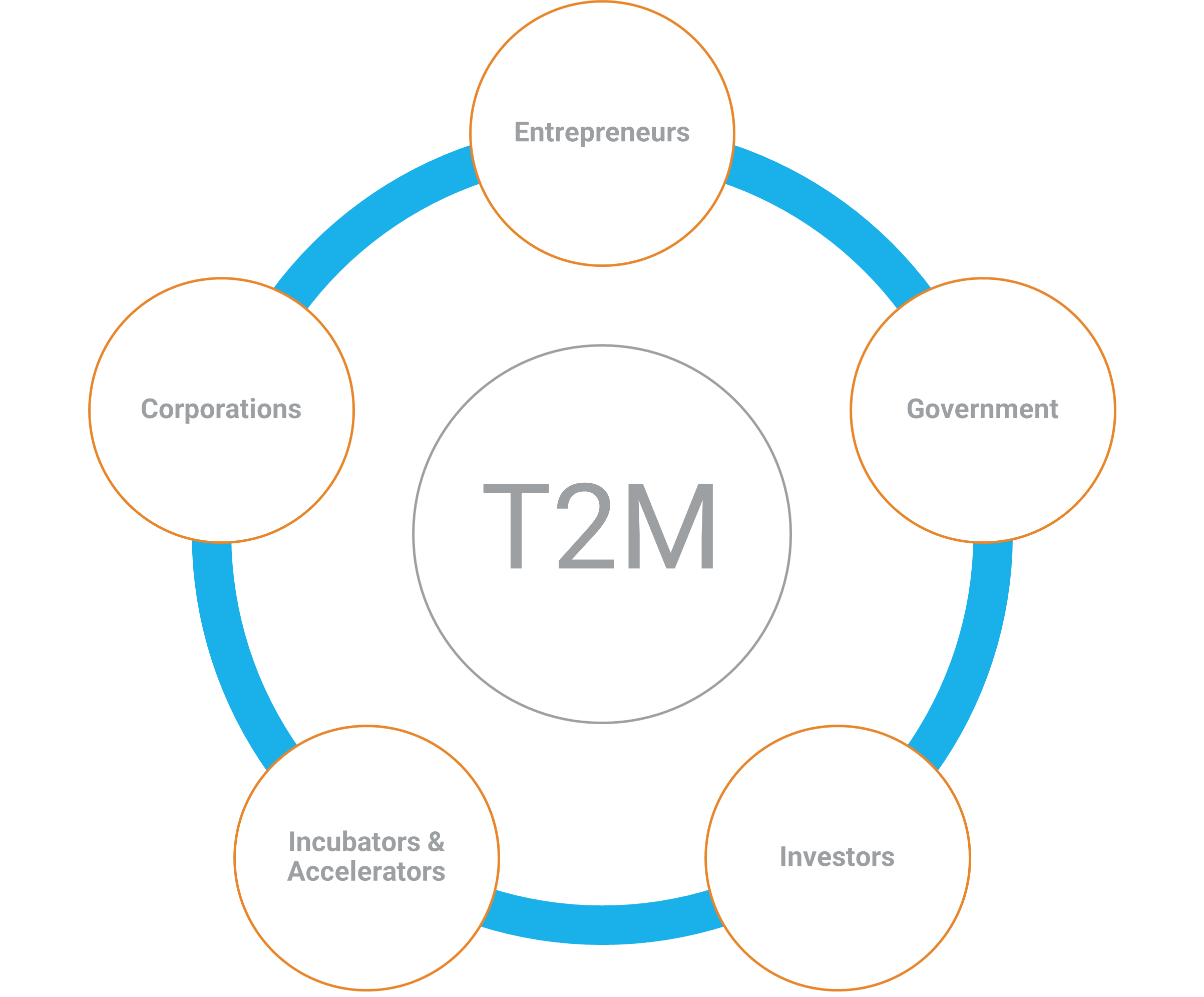

ARPA-E engages with a variety of stakeholders to support the deployment

of ARPA-E projects and other disruptive new energy technologies.

Entrepreneurs

ARPA-E funds technologies and the technologists who development. The impact of the technology depends largely on the commercial prowess of the team. To drive impact, ARPA-E seeks to help our performers build teams that can deliver technologies to market.

Government

ARPA-E plays a narrow and specific role within federal government geared toward identifying and supporting game-changing technologies for energy, but the process of bringing new technologies to market involves many other government actors at both the federal and state levels. ARPA-E works closely with these groups to ensure that its efforts and funding are well-coordinated, complementary, and non-redundant vis-à-vis other government efforts.

ARPA-E actively builds relationships and shares information with other federal agencies including the Department of Defense, the Applied Technology Programs within the Department of Energy, the Small Business Administration, the National Science Foundation, the National Institute of Standards and Technology, and many others. ARPA-E also engages with state energy agencies and regulatory bodies to maximize collaboration and coordination and identify opportunities for complementary efforts at the state level.

Investors

Sustained funding is critical for continued development and commercialization of ARPA-E technologies. ARPA-E generally funds technologies that initially pose too high of a risk for private investors. Through ARPA-E’s support, many of these technologies will be de-risked sufficiently to attract follow-on funding.

ARPA-E projects have a broad distribution of backgrounds, maturity levels, target markets, and commercialization approaches. As a result, no single class of investors is suitable for ARPA-E’s portfolio of technologies. ARPA-E projects have attracted funding from venture capital, angel investors, family offices, corporate investors, and other investment groups.

ARPA-E engages with the investment community to become familiar with the needs and interests of various investors in regard to funding disruptive energy technologies. Each class of investor, and each specific firm, has a unique set of preferences and constraints that dictates its investment thesis and the degree to which an individual project might be suitable for funding. By familiarizing ourselves with investor needs, ARPA-E can help its awardees navigate the investment landscape and successfully find a funding source that is right for them.

Incubators & Accelerators

ARPA-E engages with incubators and accelerators in the form of information sharing sessions, joint pitches, and participating in their events. ARPA-E aims to connect teams from our portfolio with incubators and accelerators that can help with the launch of their business and identification of new partners and investors. Incubators and accelerators also help the agency identify early-stage companies that could benefit from ARPA-E investment and are working on technologies that are aligned with ARPA-E’s mission.

Corporations

Engagement with corporations is important for ARPA-E. Existing companies have an intimate knowledge of market needs and can share valuable perspective on the opportunities and obstacles for new technologies to play a role. This insight is used by ARPA-E to create high-impact programs and is crucial for our awardees to help steer their efforts to innovate in these markets.

Existing corporations can also serve as valuable partners to support later-stage development, demonstration, and scale-up of ARPA-E technologies. We regularly engage with large companies to learn about their strategic interests and find areas of overlap within the ARPA-E portfolio. Where there is overlap and mutual interest, we can facilitate connections between the corporation and relevant ARPA-E funded technologies.